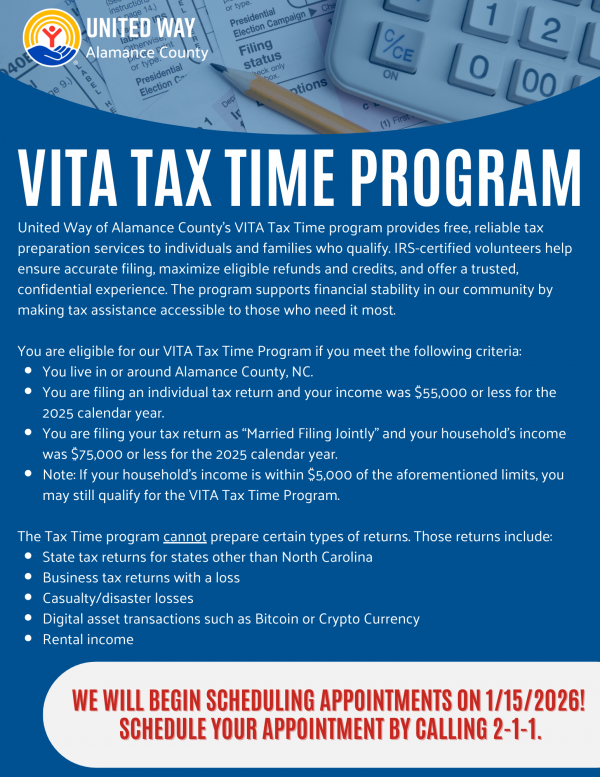

VITA Tax Time Program

United Way of Alamance County’s VITA Tax Time program will begin taking appointments on January 15, 2026.

United Way of Alamance County’s VITA Tax Time program provides free, reliable tax preparation services to individuals and families who qualify. IRS-certified volunteers help ensure accurate filing, maximize eligible refunds and credits, and offer a trusted, confidential experience. The program supports financial stability in our community by making tax assistance accessible to those who need it most.

To Schedule Appointments, call 211

Questions? Call 336.203.3332

This season's location:

Burlington Location

220 East Front Street

Burlington, NC 27215

The Tax Time Program will operate on the following schedule:

Monday: 12:00 pm - 4:30 pm

Tuesday: 9:00 am - 6:00 pm

Wednesday: 9:00 am - 6:00 pm

Thursday: 1:00 pm - 4:30 pm

Friday: 8:30 am - 11:30 am

Saturday: 8:30 am - 11:30 am

What to bring to your appointment:

- All tax documents (W-2s, 1099s, and any other forms showing income or deductions)

- Valid photo ID for yourself (and your spouse if filing jointly)

- Social Security cards or ITIN letters for everyone listed on the tax return

- Bank account and routing numbers (The IRS has stated that they will only be issuing refunds via direct deposit.)

- Last year’s tax return (if available)

Returns we cannot do:

- State returns for any states other than North Carolina

- Schedule C with net loss, depreciation or business use of home

- Complex Schedule D, Capital Gains and Losses

- Form SS-5 (request for Social Security Number)

- Form 8606 (non-deductible IRA)

- Form 8814 (child taxed at parent’s tax rate)

- Form SS-8 (determination of worker status for purposes of federal employment taxes and income tax withholding)

- Parts 4 & 5 of Form 8962 (Allocation of Policy Amounts, Alternative Calculation for Year of Marriage)

- Form W-7 (application for Individual Taxpayer Identification Number (ITIN) )

- Returns with casualty/disaster losses

- Rental Income

- Digital assets (Bitcoin or Crypto Currency) such as receiving (as a reward, award, or payment for property or services); or (b) selling, exchanging, gifting, or otherwise dispose of a digital asset (or a financial interest in a digital asset)

FREE Online Self-Preparation

Interested in preparing your own tax return? Individuals in households earning up to $66,000 can file their returns for themselves online at www.MyFreeTaxes.com, provided by H&R Block in cooperation with Cricket Wireless and United Way Worldwide. Taxpayers filing online have access to tax law experts through online chat or a toll-free phone number. This is a good option for people who have relatively simple returns, confidence in using the Internet, and a desire to be able to file their own taxes independently.

www.MyFreeTaxes.com can be used anywhere in the country 24/7.

**********************************

Programa VITA de preparación de impuestos

El programa VITA de preparación de impuestos de United Way del Condado de Alamance comenzará a aceptar citas el 15 de enero de 2026.

El programa VITA de United Way del Condado de Alamance ofrece servicios gratuitos y confiables de preparación de impuestos a personas y familias que califican. Voluntarios certificados por el IRS ayudan a garantizar la presentación precisa de las declaraciones de impuestos, maximizan los reembolsos y créditos elegibles y ofrecen una experiencia confiable y confidencial. El programa apoya la estabilidad financiera en nuestra comunidad al hacer que la asistencia fiscal sea accesible para quienes más la necesitan.

Para programar citas, llame al 211.

¿Preguntas? Llame al 336.203.3332

Ubicación de esta temporada:

Ubicación en Burlington

220 East Front Street

Burlington, NC 27215

El programa de declaración de impuestos funcionará según el siguiente calendario:

Lunes: 12:00 - 16:30

Martes: 9:00 - 18:00

Miércoles: 9:00 - 18:00

Jueves: 13:00 - 16:30

Viernes: 8:30 - 11:30

Sábado: 8:30 - 11:30

Qué debe traer a su cita:

Todos los documentos fiscales (formularios W-2, 1099 y cualquier otro formulario que muestre ingresos o deducciones)

Identificación con foto válida (para usted y su cónyuge si presentan la declaración conjunta)

Tarjetas de Seguro Social o cartas de ITIN para todas las personas incluidas en la declaración de impuestos

Números de cuenta bancaria y de ruta (El IRS ha indicado que solo emitirá reembolsos mediante depósito directo).

Declaración de impuestos del año anterior (si está disponible)

Declaraciones que no podemos preparar:

Declaraciones estatales de cualquier estado que no sea Carolina del Norte

Anexo C con pérdida neta, depreciación o uso de la vivienda para fines comerciales

Anexo D complejo, Ganancias y pérdidas de capital

Formulario SS-5 (solicitud de número de Seguro Social)

Formulario 8606 (IRA no deducible)

Formulario 8814 (hijo tributando a la tasa impositiva de los padres)

Formulario SS-8 (determinación del estatus del trabajador para fines de impuestos federales sobre el empleo y retención de impuestos sobre la renta)

Partes 4 y 5 del Formulario 8962 (Asignación de montos de póliza, Cálculo alternativo para el año del matrimonio)

Formulario W-7 (solicitud de Número de Identificación del Contribuyente Individual (ITIN))

Declaraciones con pérdidas por siniestros/desastres

Ingresos por alquiler

Activos digitales (Bitcoin o criptomonedas), como la recepción (como recompensa, premio o pago por bienes o servicios); o (b) la venta, el intercambio, la donación o cualquier otra forma de disposición de un activo digital (o un interés financiero en un activo digital)

Preparación personal GRATUITA por internet

¿Te interesa preparar tu propia declaración de impuestos? Las personas en hogares que ganan hasta $66,000 dólares pueden presentar sus declaraciones por sí mismas en línea en www.MyFreeTaxes.com, un servicio proporcionado por H&R Block en cooperación con Cricket Wireless y United Way Worldwide. Las personas que presentan su declaración por Internet tienen acceso a expertos en Derecho tributario a través del chat en línea o de un número de teléfono gratuito. Esta es una buena opción para las personas que tienen declaraciones relativamente sencillas, confianza en el uso de Internet y el deseo de poder presentar sus propios impuestos de manera independiente.

www.MyFreeTaxes.com puede ser utilizada desde cualquier lugar del país, las 24 horas y 7 días del año.